Brown Brothers Harriman Investor Services Limited RTS 28 & Article 65(6) Annual Venue Reporting – 2020

Brown Brothers Harriman Investor Services Limited (“BBHISL”) is a MiFID Investment Firm authorised and regulated by the Financial Conduct Authority to provide agency foreign exchange services to an institutional client base: eligible counterparties and professional clients only.

The classes of financial instruments for which BBHISL offers execution services are FX forwards and swaps.

Execution venue volumes include agency execution activity for both Professional Clients and Eligible Counterparties as defined in the FCA Handbook. The reporting covers BBHISL's agency execution activity for the full year 2020 and volumes are generated from BBHISL's trading records.

RTS 28

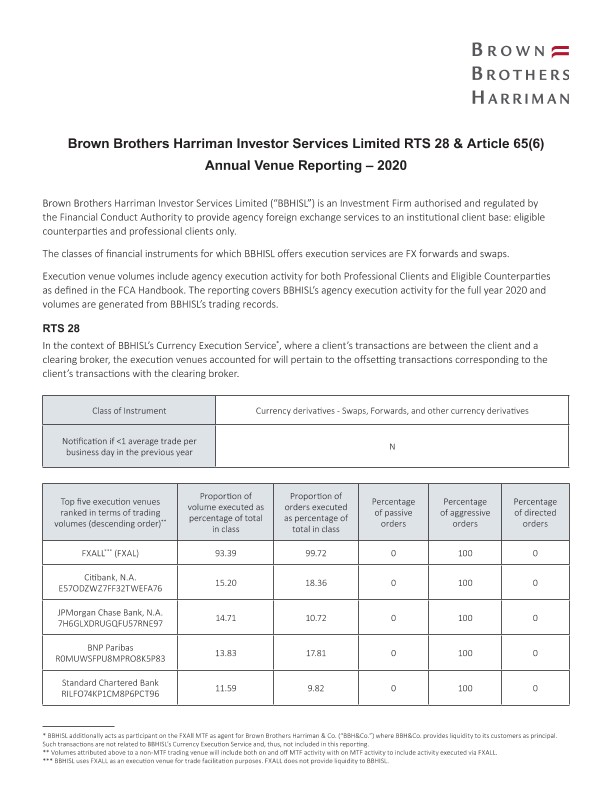

In the context of BBHISL’s Currency Execution Service*, where a client's transactions are between the client and a clearing broker, the execution venues accounted for will pertain to the offsetting transactions corresponding to the client’s transactions with the clearing broker.

| Class of Instrument |

Currency derivatives - Swaps, Forwards, and other currency derivatives |

||||

|---|---|---|---|---|---|

| Notification if <1 average trade per business day in the previous year | N |

||||

| Top five execution venues ranked in terms of trading volumes (descending order)** | Proportion of volume executed as percentage of total in class | Proportion of orders executed as percentage of total in class | Percentage of passive orders | Percentage of aggressive orders | Percentage of directed orders |

| FXALL*** (FXAL) |

93.39 | 99.72 | 0 | 100 | 0 |

| Citibank, N.A. E57ODZWZ7FF32TWEFA76 | 15.20 | 18.36 | 0 | 100 | 0 |

| JPMorgan Chase Bank, N.A. 7H6GLXDRUGQFU57RNE97 | 14.71 | 10.72 | 0 | 100 | 0 |

| BNP Paribas R0MUWSFPU8MPRO8K5P83 | 13.83 | 17.81 | 0 | 100 | 0 |

| Standard Chartered Bank RILFO74KP1CM8P6PCT96 | 11.59 | 9.82 | 0 | 100 | 0 |

*BBHISL additionally acts as participant on the FXAll MTF as agent for Brown Brothers Harriman & Co. (“BBH&Co.”) where BBH&Co. provides liquidity to its customers as principal. Such transactions are not related to BBHISL’s Currency Execution Service and, thus, not included in this reporting.

**Volumes attributed above to a non-MTF trading venue will include both on and off MTF activity with on MTF activity to include activity executed via FXALL.

***BBHISL uses FXALL as an execution venue for trade facilitation purposes. FXALL does not provide liquidity to BBHISL.

Article 65 (6)

In the context of BBHISL’s Currency Execution Service, execution venues accounted for will pertain to client transactions executed with the clearing broker.

| Class of Instrument |

Currency derivatives - Swaps, Forwards, and other currency derivatives |

||||

|---|---|---|---|---|---|

| Notification if <1 average trade per business day in the previous year | N |

||||

| Top five execution venues ranked in terms of trading volumes (descending order)** | Proportion of volume executed as percentage of total in class | Proportion of orders executed as percentage of total in class | Percentage of passive orders | Percentage of aggressive orders | Percentage of directed orders |

| Citibank, N.A. E57ODZWZ7FF32TWEFA76 |

65.46 |

74.35 |

0 | 100 | 0 |

| HSBC Bank PLC MP6I5ZYZBEU3UXPYFY54 |

26.31 |

21.23 |

0 | 100 | 0 |

| Standard Chartered Bank RILFO74KP1CM8P6PCT96 |

8.23 |

4.42 |

0 | 100 | 0 |

In accordance with the requirements of COBS 11 Annex 1 UK Regulatory Technical Standard 28 (RTS 28), this document sets out the conclusions of the review and analysis undertaken by BBHISL relating to the 2020 reporting period.

An explanation of the relative importance the firm gave to the execution factors of price, costs, speed, likelihood of execution or any other consideration including qualitative factors when assessing the quality of execution

BBHISL acted in accordance with its Order Execution Policy, with the objective of taking all sufficient steps to obtain the best possible result for its clients. Several factors were considered in the weight that was given to the execution factors, including the size and nature of the client’s request and the market conditions at the time. However, the general prevailing factor in relation to execution, on the whole, is the price consideration.

A description of any close links, conflicts of interest and common ownerships with respect to any execution venues used to execute orders.

There are no close links or a common ownership structure between BBHISL and any execution venues used to execute orders.

A description of any specific arrangements with any execution venues regarding payments made or received, discounts, rebates or non-monetary benefits received.

BBHISL has arrangements with clearing brokers which waive transaction costs if the broker is also selected for execution. Trading with such counterparties is conducted in compliance with the firm’s Conflict of Interest Policy and BBHISL’s Order Handling Policy and such arrangements do not include being compensated, either directly or indirectly, for any business directed to such execution venues.

An explanation of the factors that led to a change in the list of execution venues listed in the firm’s execution policy if such change occurred.

BBHISL continuously reviews its panel of execution venues and adds/removes venues as appropriate based on the below factors: size and nature of the order; likelihood of execution and settlement; market volatility; perceived liquidity; speed of execution; and costs. There were no material changes to the list of execution venues utilised in 2020.

An explanation of how order execution differs according to client categorisation, where the firm treats categories of clients differently and where it may affect the order execution arrangements.

BBHISL does not execute orders for retail clients and its professional clients were treated in accordance with the firm’s Order Execution Policy and the considerations detailed herein.

An explanation of whether other criteria were given precedence over immediate price and cost when executing retail client orders and how these other criteria were instrumental in delivering the best possible result in terms of the total consideration to the client.

BBHISL does not execute orders for retail clients.

An explanation of how the investment firm has used any data or toolsrelating to the quality of execution, including any data published under Delegated Regulation (EU) 2017/575.

A daily review of BBHISL’s trade execution is undertaken by the firm’s risk management team. Additionally, periodic analysis related to execution quality and use of execution venues is undertaken by the BBHISL Order Handling Committee.

Where applicable, an explanation of how the investment firm has used output of a consolidated tape provider authorised in accordance with the Data Reporting Services Regulations 2017.

Not applicable