Brown Brothers Harriman Investor Services Limited MiFID RTS 28 & Article 65(6) Annual Venue Reporting–2018

Brown Brothers Harriman Investor Services Limited(“BBHISL”) is a MiFID Investment Firm authorised and regulated by the Financial Conduct Authority to provide agency foreign exchange services to an institutional client base: eligible counterparties and professional clients only.

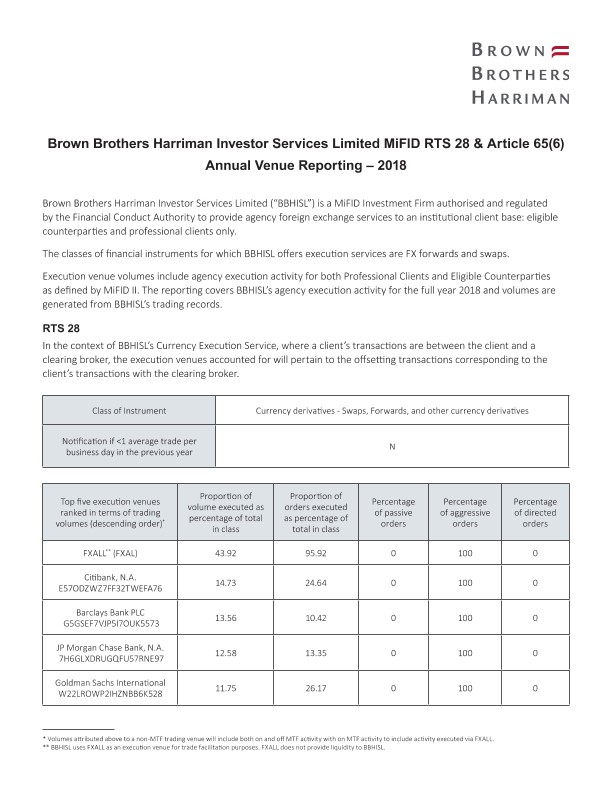

The classes of financial instruments for which BBHISL offers execution services are FX forwards and swaps.

Execution venue volumes include agency execution activity for both Professional Clients and Eligible Counterparties as defined by MiFID II. The reporting covers BBHISL's agency execution activity for the full year 2018 and volumes are generated from BBHISL's trading records.

RTS 28

In the context of BBHISL’s Currency Execution Service, where a client's transactions are between the client and a clearing broker, the execution venues accounted for will pertain to the offsetting transactions corresponding to the client’s transactions with the clearing broker.

| Class of Instrument | Currency derivatives - Swaps, Forwards, and other currency derivatives | ||||

|---|---|---|---|---|---|

| Notification if <1 average trade per business day in the previous year | N | ||||

| Top five execution venues ranked in terms of trading volumes (descending order)* | Proportion of volume executed as percentage of total in class | Proportion of orders executed as percentage of total in class |

Percentage of passive orders | Percentage of aggressive orders | Percentage of directed orders |

| FXALL** (FXAL) | 43.92 | 95.92 | 0 | 100 | 0 |

| Citibank, N.A. E57ODZWZ7FF32TWEFA76 |

14.73 | 24.64 | 0 | 100 | 0 |

| Barclays Bank PLC G5GSEF7VJP5I7OUK5573 |

13.56 | 10.42 | 0 | 100 | 0 |

| JP Morgan Chase Bank, N.A. 7H6GLXDRUGQFU57RNE97 | 12.58 | 13.35 | 0 | 100 | 0 |

| Goldman Sachs International W22LROWP2IHZNBB6K528 | 11.75 | 26.17 | 0 | 100 | 0 |

*Volumes attributed above to a non-MTF trading venue will include both on and off MTF activity with on MTF activity to include activity executed via FXALL.

**BBHISL uses FXALL as an execution venue for trade facilitation purposes. FXALL does not provide liquidity to BBHISL.

Article 65 (6)

In the context of BBHISL’s Currency Execution Service, execution venues accounted for will pertain to client transactions executed with the clearing broker.

| Class of Instrument | Currency derivatives - Swaps, Forwards, and other currency derivatives | ||||

|---|---|---|---|---|---|

| Notification if <1 average trade per business day in the previous year | N | ||||

| Top five execution venues ranked in terms of trading volumes (descending order) |

Proportion of volume executed as percentage of total in class | Proportion of orders executed as percentage of total in class | Percentage of passive orders | Percentage of aggressive orders | Percentage of directed orders |

| Citibank, N.A. E57ODZWZ7FF32TWEFA76 |

77.02 | 82.27 | 0 | 100 | 0 |

| HSBC Bank PLC MP6I5ZYZBEU3UXPYFY54 |

22.98 | 17.73 | 0 | 100 | 0 |

In accordance with the requirements of Article 27(6) of MiFID II and as detailed in Article 3 of Commission Delegated regulation (EU) 2017/576, this document sets out the conclusions of the review and analysis undertaken by BBHISL relating to the 2018 reporting period.

An explanation of the relative importance the firm gave to the execution factors of price, costs, speed, likelihood of execution or any other consideration including qualitative factors when assessing the quality of execution

BBHISL acted in accordance with its Order Execution Policy, with the objective of taking all sufficient steps to obtain the best possible result for its clients. Several factors were considered in the weight that was given to the execution factors, including the size and nature of the client’s request and the market conditions at the time. However, the general prevailing factor in relation to execution, on the whole, is the price consideration.

A description of any close links, conflicts of interest and common ownerships with respect to any execution venues used to execute orders

There are no close links or a common ownership structure between BBHISL and any execution venues used to execute orders.

A description of any specific arrangements with any execution venues regarding payments made or received, discounts, rebates or non-monetary benefits received

BBHISL has arrangements with clearing brokers which waive transaction costs if the broker is also selected for execution. Trading with such counterparties is conducted in compliance with the firm’s Conflict of Interest Policy and BBHISL’s Order Handling Policy and such arrangements do not include being compensated, either directly or indirectly, for any business directed to such execution venues.

An explanation of the factors that led to a change in the list of execution venues listed in the firm’s execution policy if such change occurred

BBHISL continuously reviews its panel of execution venues and adds/removes venues as appropriate based on the below factors: size and nature of the order; likelihood of execution and settlement; market volatility; perceived liquidity; speed of execution; and costs. There were no material changes to the list of execution venues utilised in 2018.

An explanation of how order execution differs according to client categorisation, where the firm treats categories of clients differently and where it may affect the order execution arrangements

BBHISL does not execute orders for retail clients and its professional clients were treated in accordance with the firm’s Order Execution Policy and the considerations detailed herein.

An explanation of whether other criteria were given precedence over immediate price and cost when executing retail client orders and how these other criteria were instrumental in delivering the best possible result in terms of the total consideration to the client

BBHISL does not execute orders for retail clients.

An explanation of how the investment firm has used any data or toolsrelating to the quality of execution, including any data published under Delegated Regulation (EU) 2017/575

A daily review of BBHISL’s trade execution is undertaken by the firm’s risk management team. Additionally, periodic analysis related to execution quality and use of execution venues is undertaken by the BBHISL Order Handling Committee.

Where applicable, an explanation of how the investment firm has used output of a consolidated tape provider established under Article 65 of Directive 2014/65/EU

Not applicable